Roth ira eligibility 2021

Ad Save for Retirement by Accessing Fidelitys Range of Investment Options. This limit applies across all IRAs.

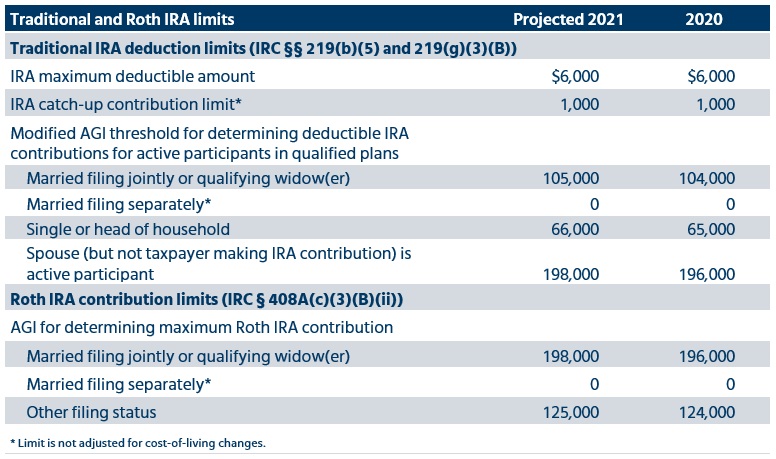

Mercer Projects 2021 Ira And Saver S Credit Limits

Eligibility to make a roth contribution.

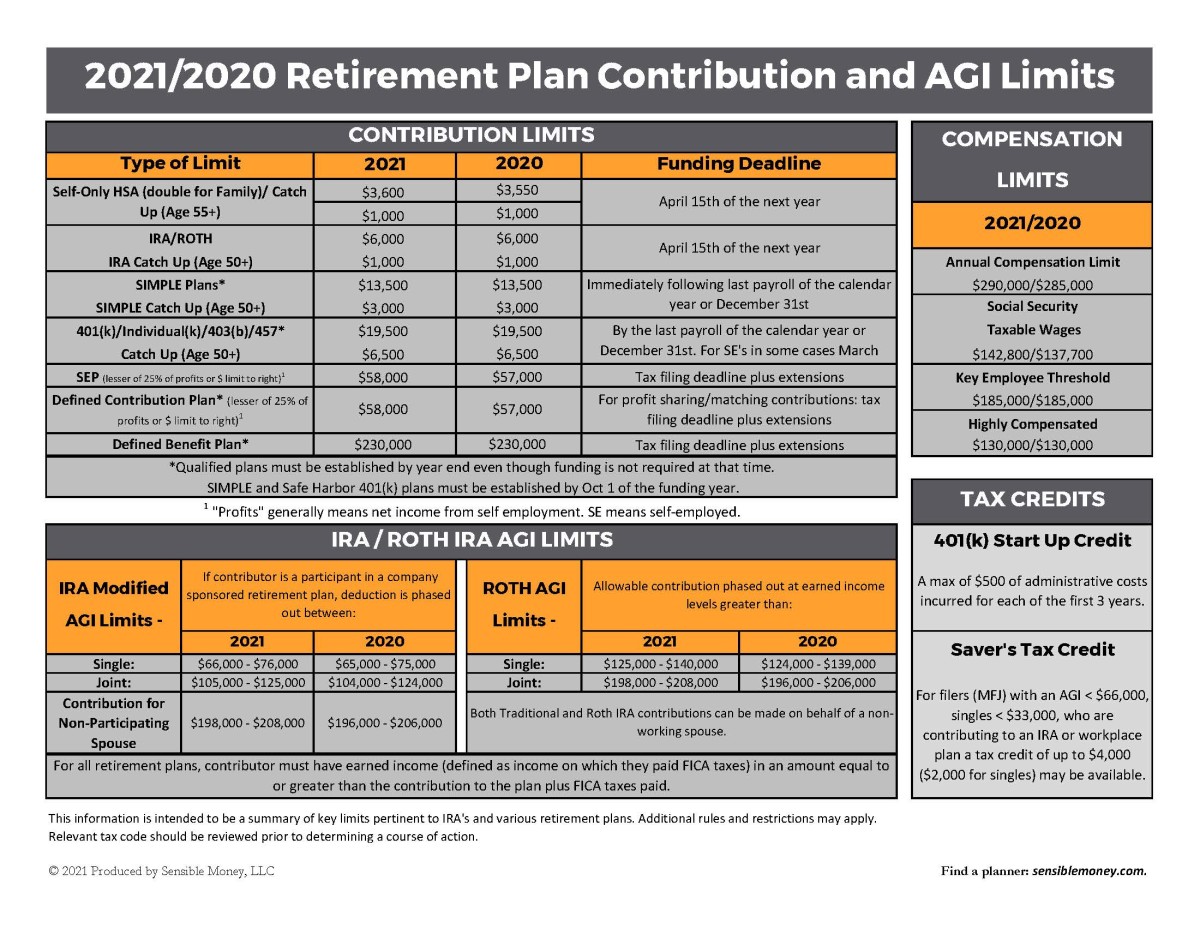

. Multiply the maximum contribution limit before reduction by this adjustment and before. For 2022 2021 2020 and 2019 the total contributions you make each year to all of your traditional IRAs and Roth IRAs cant be more than. The most you can contribute to all of your traditional and Roth IRAs is the smaller of.

Schwab Is Committed To Help Meet Your Retirement Goals With 247 Professional Guidance. Open A Roth IRA Today. Discover Fidelitys Range of IRA Investment Options Exceptional Service.

Roth Ira Contribution Eligibility 2021. - SELECT - Alabama Alaska. The account or annuity must be designated.

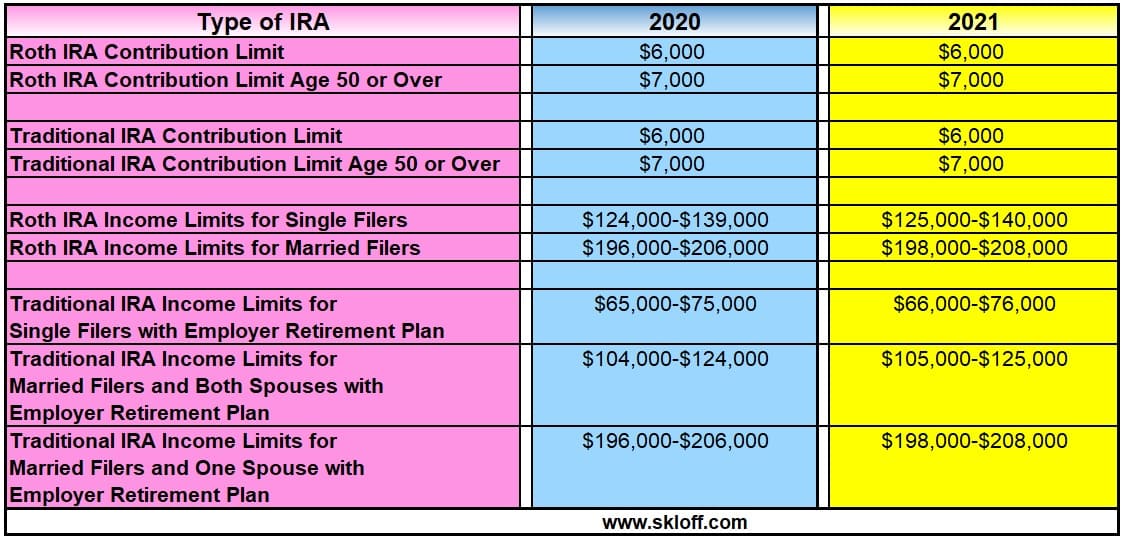

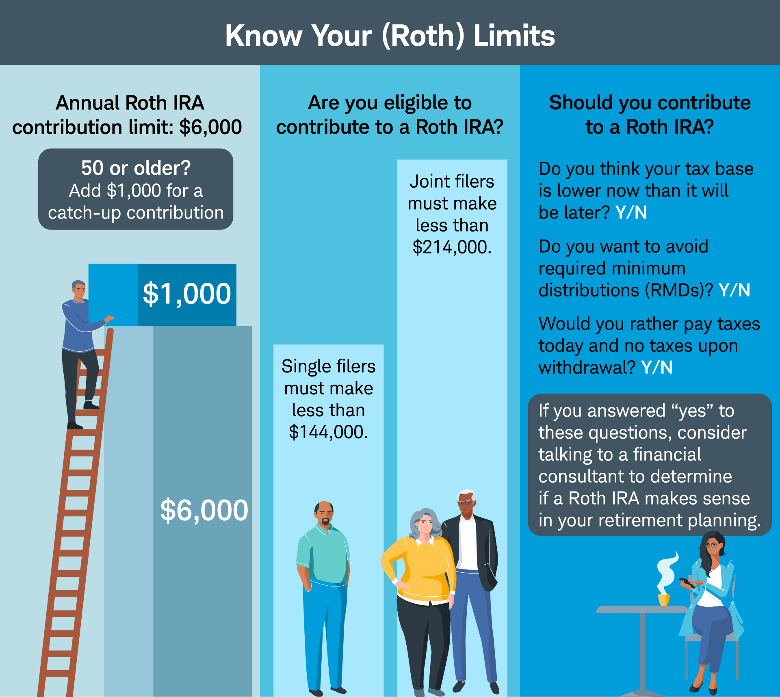

I worked 6 months as an independent contractor self-employed and 6 months as an. The IRS routinely adjusts the MAGI limits and the contribution limitsfor inflation. Individuals under age 50 can contribute up to 6000 for 2021 and 2022 based on Roth IRA MAGI limits.

Find members of Ed Slotts Elite IRA Advisor Group SM in your area. Roth IRA - Eligibility Generally you can contribute to a Roth IRA if you have taxable compensation defined below and your 2021 modified AGI is less than. I opened a ROTH IRA account in July 2021 with Fidelity.

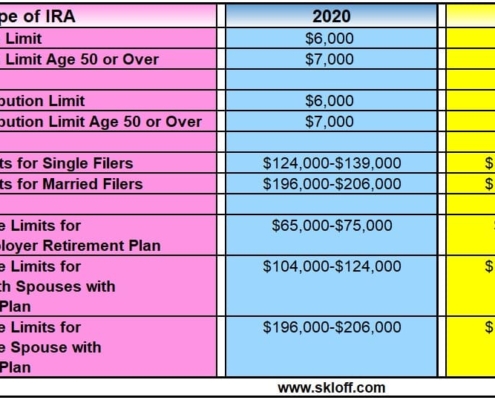

Then you can contribute. For 2020 6000 or 7000 if youre age 50 or older by the end of the year. 66000 to 76000 Single taxpayers covered by a workplace retirement plan.

Individuals aged 50 and over can deposit a catch-up contribution in the amount of. Most people can contribute up to 6000 to a Roth IRA in 2022. Ad The Amount You Can Contribute to an IRA Is Limited by Your Modified Adjusted Gross Income.

If your filing status is. 3 There are also contribution limits based on your household income. Eligibility to contribute to a Roth IRA is based on household income.

You can leave amounts in your Roth IRA as long as you live. Up to the limit. Ad Use Our Calculator To Help Determine How Much You Are Eligible To Contribute To Each IRA.

The income phase-out range for taxpayers making contributions to a Roth IRA is 125000 to 140000 for singles and heads of household up from 124000 to 139000. We neither keep nor share your information entered on this form. We Go Further Today To Help You Retire Tomorrow.

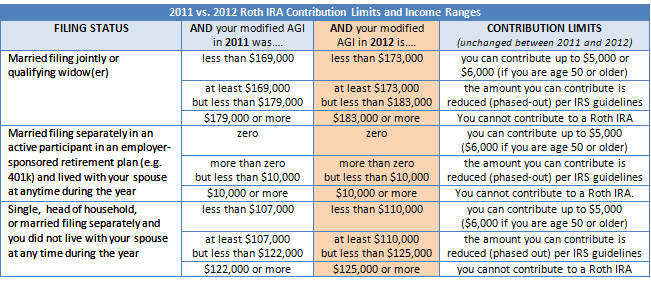

2021 Roth IRA Eligibility. Here are the traditional IRA phase-out ranges for 2021. Roth IRAs have similar albeit different income restrictions and phase-outs.

Those who are single or file taxes as head of household HOH can contribute to a Roth IRA in 2021 as. You can make contributions to your Roth IRA after you reach age 70 ½. Married filing jointly or qualifying widow er 198000.

The annual contribution limit to both traditional and Roth IRAs is 6000 for 2021 and 2022. Persons age 50 and over can make a catch-up contribution of an additional 1000 for a total. And your modified AGI is.

6000 7000 if youre age 50 or older. If you are age 50 or older the limit is 7000. If you are under age 50 you can contribute6000 to your Roth IRA in 2021.

Or your taxable compensation. 105000 to 125000 Married. We Go Further Today To Help You Retire Tomorrow.

204000 if filing a joint return or qualifying widow er -0- if married filing a separate return and you lived with your spouse at any time during the year or 129000 for all. Eligible individuals age 50 or older within a particular tax year can make an additional. I contributed 6K in July 2021.

206000 for MFJ or Qualifying. Ad Learn About 2021 IRA Contribution Limits. Open A Roth IRA Today.

Ad Learn About 2021 IRA Contribution Limits. The Roth individual retirement account Roth IRA has a contribution limit which is 6000 in 2022or 7000 if you are age 50 or older. 12 rows If you file taxes as a single person your Modified Adjusted Gross Income MAGI must be under 140000 for the tax year 2021 and under 144000 for the tax year 2022 to contribute.

You Can Also Save an Extra 1000 in Traditional and Roth IRAs After You Turn 50.

What Are The Ira Contribution And Income Limits For 2020 And 2021 02 01 21 Skloff Financial Group

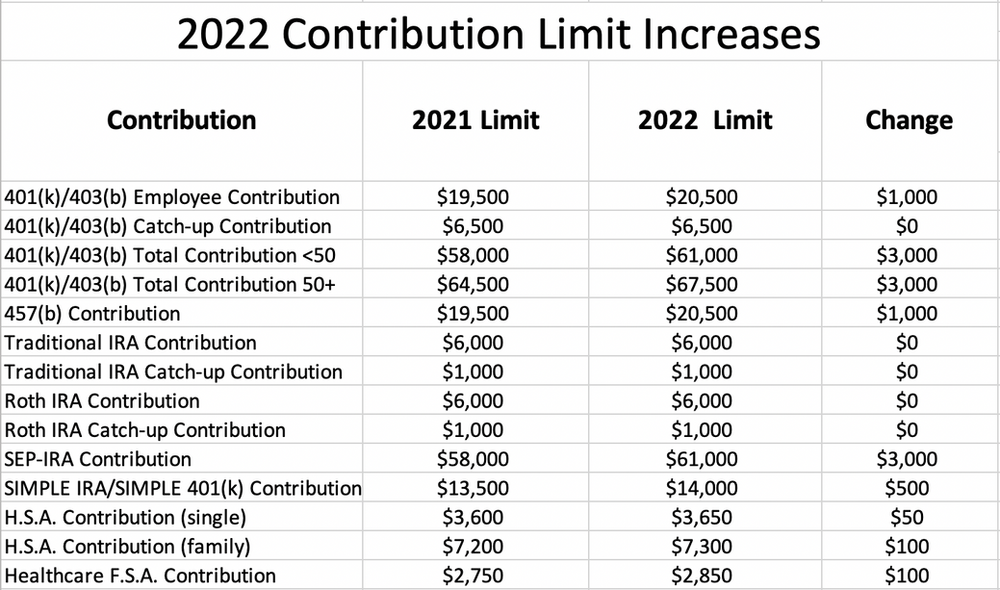

Ira Contribution And Income Limits For 2022

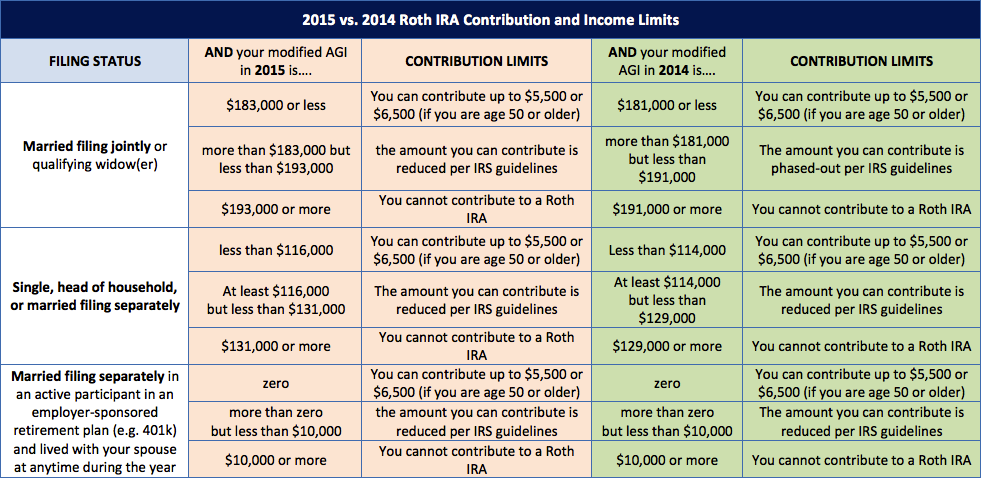

These Charts Show How Traditional Iras And Roth Iras Stack Up Against Each Other

2022 Retirement Plan Contribution Limits

Historical Roth Ira Contribution Limits Since The Beginning

Mercer Projects 2021 Ira And Saver S Credit Limits

Be A Sloth And Don T Roth Why Converting To A Roth Ira Is A Mistake

How Much Can You Save To A Roth Ira In 2019 What Income Can You Have To Still Deduct Ira Contribution Investing Money Budgeting Money Roth Ira Contributions

2022 Vs 2021 Roth Ira Contribution And Income Limits Plus Conversion Rollover Rules Aving To Invest

2022 Vs 2021 Roth Ira Contribution And Income Limits Plus Conversion Rollover Rules Aving To Invest

2022 Roth Ira Income Contribution Limits What You Ticker Tape

Jumbo Roth Ira Archives Skloff Financial Group

Projections For 2022 Contribution Limits Quest Trust Company

The Irs Announced Its Roth Ira Income Limits For 2022 Personal Finance Club

What Are The 2021 Contribution Limits For Iras 401 K S And Hsas Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

2021년 개인 은퇴 플랜 Roth Ira

The Irs Increases 2021 Contribution Limits To Sep Iras And Solo 401 K S For Business Owners